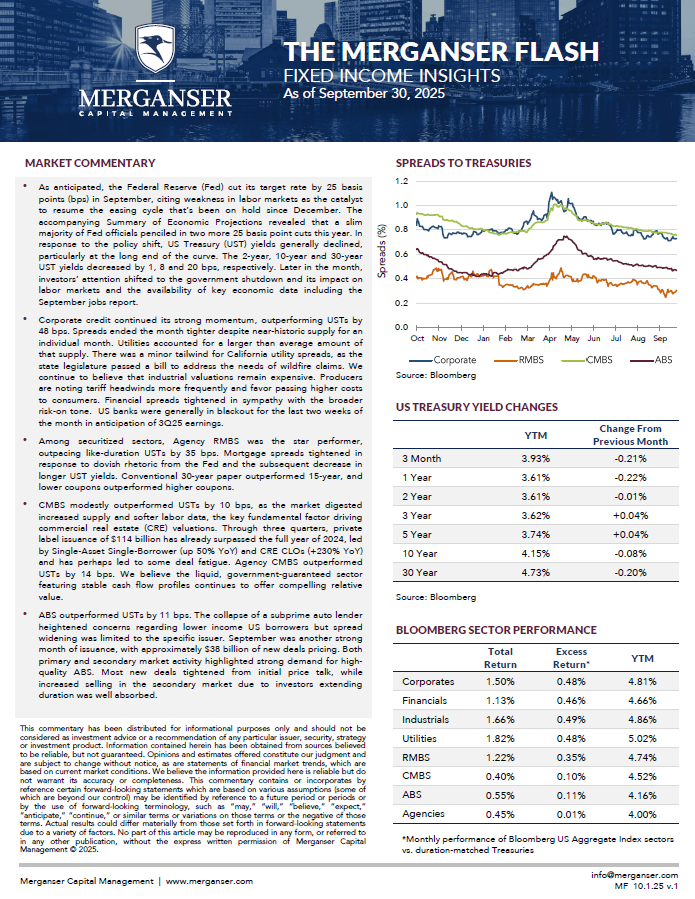

- As anticipated, the Federal Reserve (Fed) cut its target rate by 25 basis points (bps) in September, citing weakness in labor markets as the catalyst to resume the easing cycle that’s been on hold since December. The accompanying Summary of Economic Projections revealed that a slim majority of Fed officials penciled in two more 25 basis point cuts this year. In response to the policy shift, US Treasury (UST) yields generally declined, particularly at the long end of the curve. The 2-year, 10-year, and 30-year UST yields decreased by 1, 8, and 20 bps, respectively. Later in the month, investors’ attention shifted to the government shutdown and its impact on labor markets and the availability of key economic data including the September jobs report.

- Corporate credit continued its strong momentum, outperforming USTs by 48 bps. Spreads ended the month tighter despite near-historic supply for an individual month. Utilities accounted for a larger than average amount of that supply. There was a minor tailwind for California utility spreads, as the state legislature passed a bill to address the needs of wildfire claims. We continue to believe that industrial valuations remain expensive. Producers are noting tariff headwinds more frequently and favor passing higher costs to consumers. Financial spreads tightened in sympathy with the broader risk-on tone. US banks were generally in blackout for the last two weeks of the month in anticipation of 3Q25 earnings.

- Among securitized sectors, Agency RMBS was the star performer, outpacing like-duration USTs by 35 bps. Mortgage spreads tightened in response to dovish rhetoric from the Fed and the subsequent decrease in longer UST yields. Conventional 30-year paper outperformed 15-year, and lower coupons outperformed higher coupons.

- CMBS modestly outperformed USTs by 10 bps, as the market digested increased supply and softer labor data, the key fundamental factor driving commercial real estate (CRE) valuations. Through three quarters, private label issuance of $114 billion has already surpassed the full year of 2024, led by Single-Asset Single-Borrower (up 50% YoY) and CRE CLOs (+230% YoY) and has perhaps led to some deal fatigue. Agency CMBS outperformed USTs by 14 bps. We believe the liquid, government-guaranteed sector featuring stable cash flow profiles continues to offer compelling relative value.

- ABS outperformed USTs by 11 bps. The collapse of a subprime auto lender heightened concerns regarding lower income US borrowers but spread widening was limited to the specific issuer. September was another strong month of issuance, with approximately $38 billion of new deals pricing. Both primary and secondary market activity highlighted strong demand for high-quality ABS. Most new deals tightened from initial price talk, while increased selling in the secondary market due to investors extending duration was well absorbed.