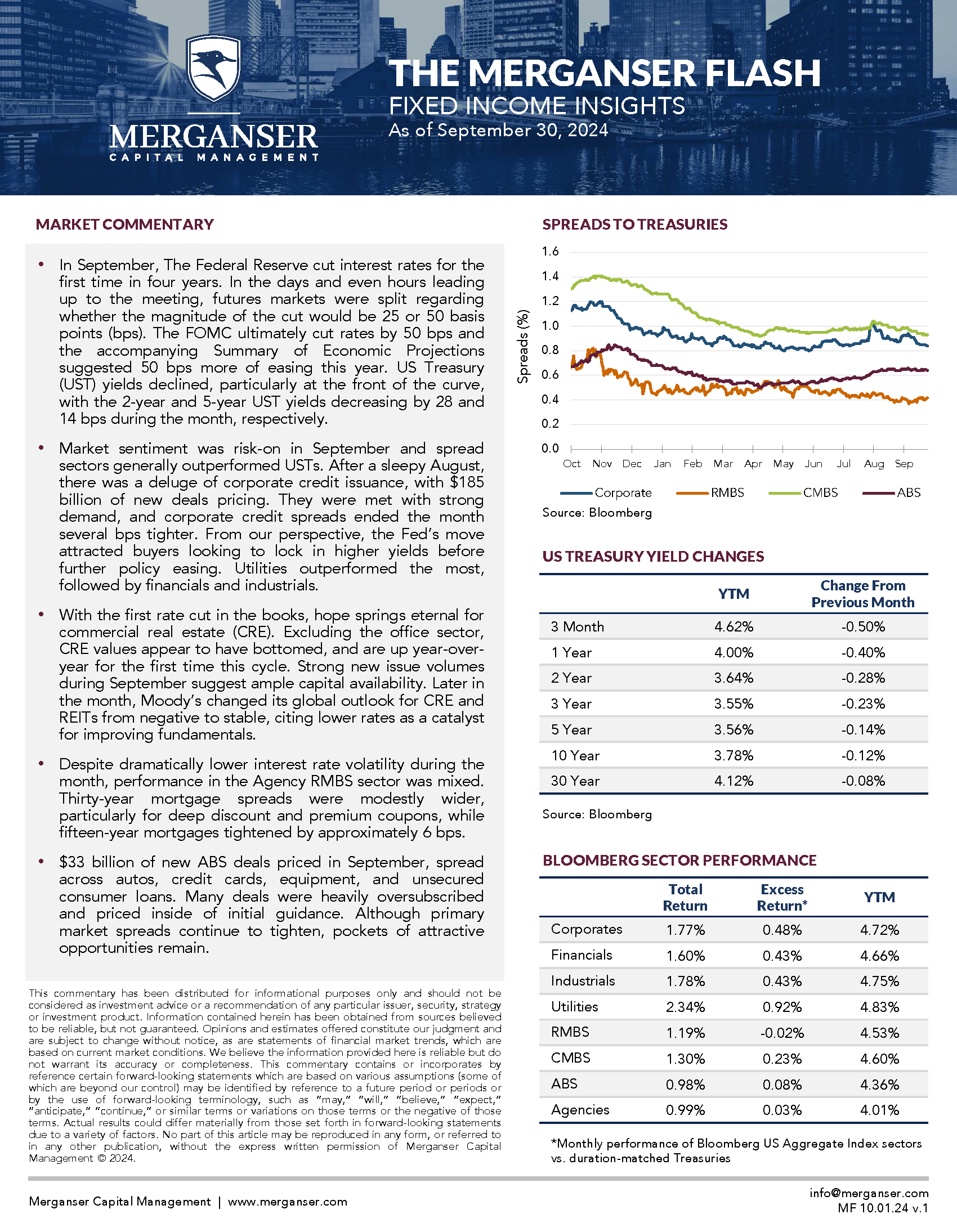

- In September, The Federal Reserve cut interest rates for the first time in four years. In the days and even hours leading up to the meeting, futures markets were split regarding whether the magnitude of the cut would be 25 or 50 basis points (bps). The FOMC ultimately cut rates by 50 bps and the accompanying Summary of Economic Projections suggested 50 bps more of easing this year. US Treasury (UST) yields declined, particularly at the front of the curve, with the 2-year and 5-year UST yields decreasing by 28 and 14 bps during the month, respectively.

- Market sentiment was risk-on in September and spread sectors generally outperformed USTs. After a sleepy August, there was a deluge of corporate credit issuance, with $185 billion of new deals pricing. They were met with strong demand, and corporate credit spreads ended the month several bps tighter. From our perspective, the Fed’s move attracted buyers looking to lock in higher yields before further policy easing. Utilities outperformed the most, followed by financials and industrials.

- With the first rate cut in the books, hope springs eternal for commercial real estate (CRE). Excluding the office sector, CRE values appear to have bottomed, and are up year-over-year for the first time this cycle. Strong new issue volumes during September suggest ample capital availability. Later in the month, Moody’s changed its global outlook for CRE and REITs from negative to stable, citing lower rates as a catalyst for improving fundamentals.

- Despite dramatically lower interest rate volatility during the month, performance in the Agency RMBS sector was mixed. Thirty-year mortgage spreads were modestly wider, particularly for deep discount and premium coupons, while fifteen-year mortgages tightened by approximately 6 bps.

- $33 billion of new ABS deals priced in September, spread across autos, credit cards, equipment, and unsecured consumer loans. Many deals were heavily oversubscribed and priced inside of initial guidance. Although primary market spreads continue to tighten, pockets of attractive opportunities remain.