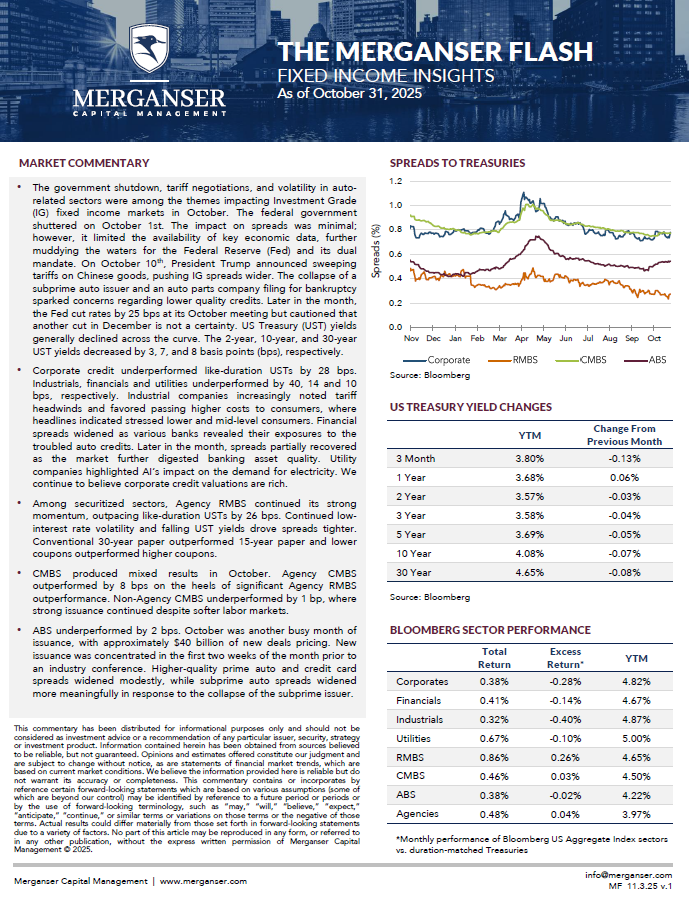

- The government shutdown, tariff negotiations, and volatility in auto-related sectors were among the themes impacting Investment Grade (IG) fixed income markets in October. The federal government shuttered on October 1st. The impact on spreads was minimal; however, it limited the availability of key economic data, further muddying the waters for the Federal Reserve (Fed) and its dual mandate. On October 10th, President Trump announced sweeping tariffs on Chinese goods, pushing IG spreads wider. The collapse of a subprime auto issuer and an auto parts company filing for bankruptcy sparked concerns regarding lower quality credits. Later in the month, the Fed cut rates by 25 bps at its October meeting but cautioned that another cut in December is not a certainty. US Treasury (UST) yields generally declined across the curve. The 2-year, 10-year, and 30-year UST yields decreased by 3, 7, and 8 basis points (bps), respectively.

- Corporate credit underperformed like-duration USTs by 28 bps. Industrials, financials and utilities underperformed by 40, 14 and 10 bps, respectively. Industrial companies increasingly noted tariff headwinds and favored passing higher costs to consumers, where headlines indicated stressed lower and mid-level consumers. Financial spreads widened as various banks revealed their exposures to the troubled auto credits. Later in the month, spreads partially recovered as the market further digested banking asset quality. Utility companies highlighted AI’s impact on the demand for electricity. We continue to believe corporate credit valuations are rich.

- Among securitized sectors, Agency RMBS continued its strong momentum, outpacing like-duration USTs by 26 bps. Continued low-interest rate volatility and falling UST yields drove spreads tighter. Conventional 30-year paper outperformed 15-year paper and lower coupons outperformed higher coupons.

- CMBS produced mixed results in October. Agency CMBS outperformed by 8 bps on the heels of significant Agency RMBS outperformance. Non-Agency CMBS underperformed by 1 bp, where strong issuance continued despite softer labor markets.

- ABS underperformed by 2 bps. October was another busy month of issuance, with approximately $40 billion of new deals pricing. New issuance was concentrated in the first two weeks of the month prior to an industry conference. Higher-quality prime auto and credit card spreads widened modestly, while subprime auto spreads widened more meaningfully in response to the collapse of the subprime issuer.