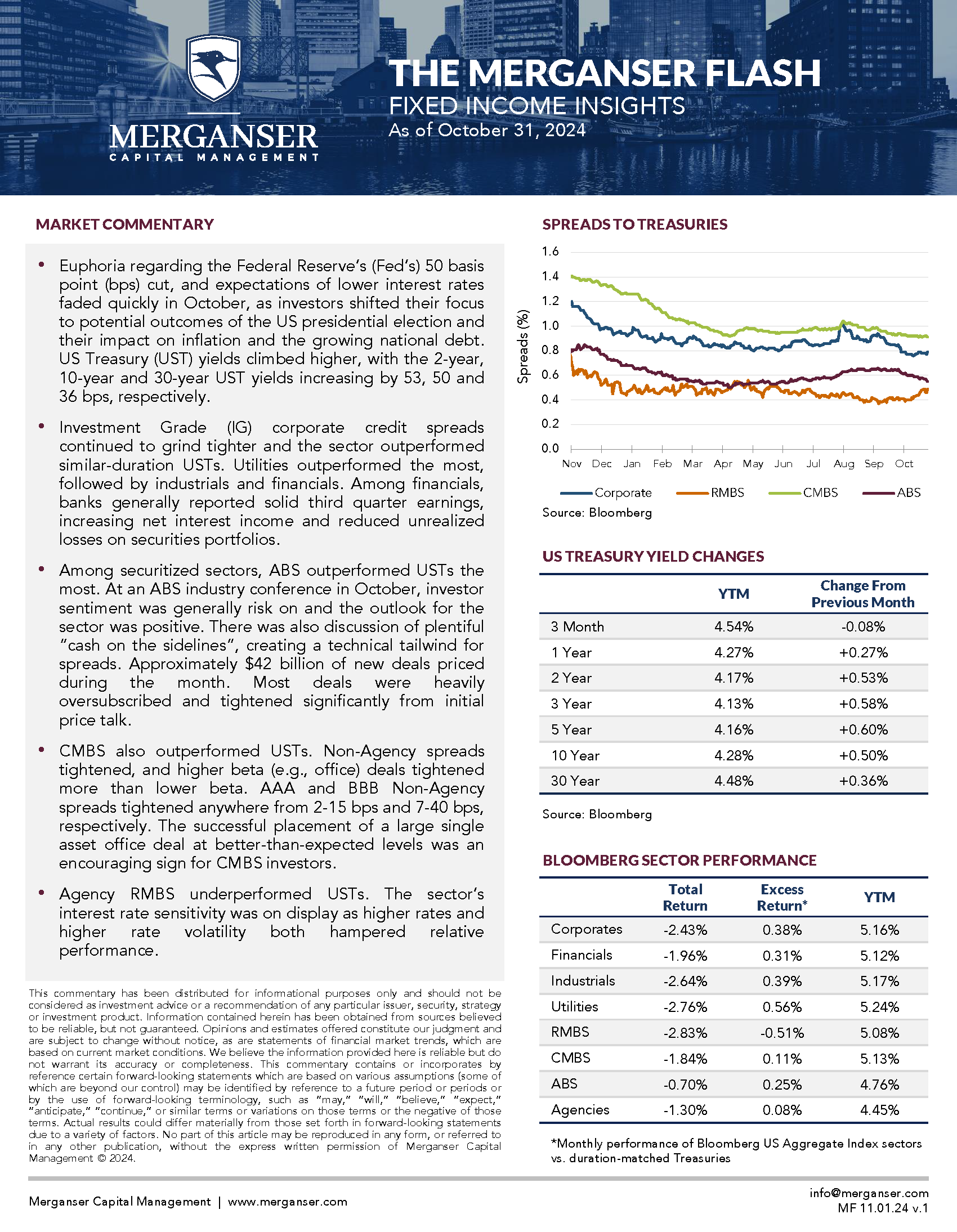

- Euphoria regarding the Federal Reserve’s (Fed’s) 50 basis point (bps) cut, and expectations of lower interest rates faded quickly in October, as investors shifted their focus to potential outcomes of the US presidential election and their impact on inflation and the growing national debt. US Treasury (UST) yields climbed higher, with the 2-year, 10-year and 30-year UST yields increasing by 53, 50 and 36 bps, respectively.

- Investment Grade (IG) corporate credit spreads continued to grind tighter and the sector outperformed similar-duration USTs. Utilities outperformed the most, followed by industrials and financials. Among financials, banks generally reported solid third quarter earnings, increasing net interest income and reduced unrealized losses on securities portfolios.

- Among securitized sectors, ABS outperformed USTs the most. At an ABS industry conference in October, investor sentiment was generally risk on and the outlook for the sector was positive. There was also discussion of plentiful “cash on the sidelines”, creating a technical tailwind for spreads. Approximately $42 billion of new deals priced during the month. Most deals were heavily oversubscribed and tightened significantly from initial price talk.

- CMBS also outperformed USTs. Non-Agency spreads tightened, and higher beta (e.g., office) deals tightened more than lower beta. AAA and BBB Non-Agency spreads tightened anywhere from 2-15 bps and 7-40 bps, respectively. The successful placement of a large single asset office deal at better-than-expected levels was an encouraging sign for CMBS investors.

- Agency RMBS underperformed USTs. The sector’s interest rate sensitivity was on display as higher rates and higher rate volatility both hampered relative performance.