- The swift failure of Silicon Valley Bank (SVB) sparked fears of contagion in the global financial system that reverberated across capital markets. While the Federal Reserve (Fed) and other agencies stepped in with facilities to reinforce liquidity, uncertainty persisted, and investors piled into US Treasuries, pushing yields significantly lower during the month. The 2-Year and 10-Year US Treasury yields decreased by 74 and 35 basis points (bps), respectively.

- On March 22nd the Fed increased its target rate by 25 bps and notably softened its message regarding future rate increases. Accompanying projections by Fed officials did not suggest any near term easing of monetary policy. Despite this, futures markets are still predicting rate cuts later this year.

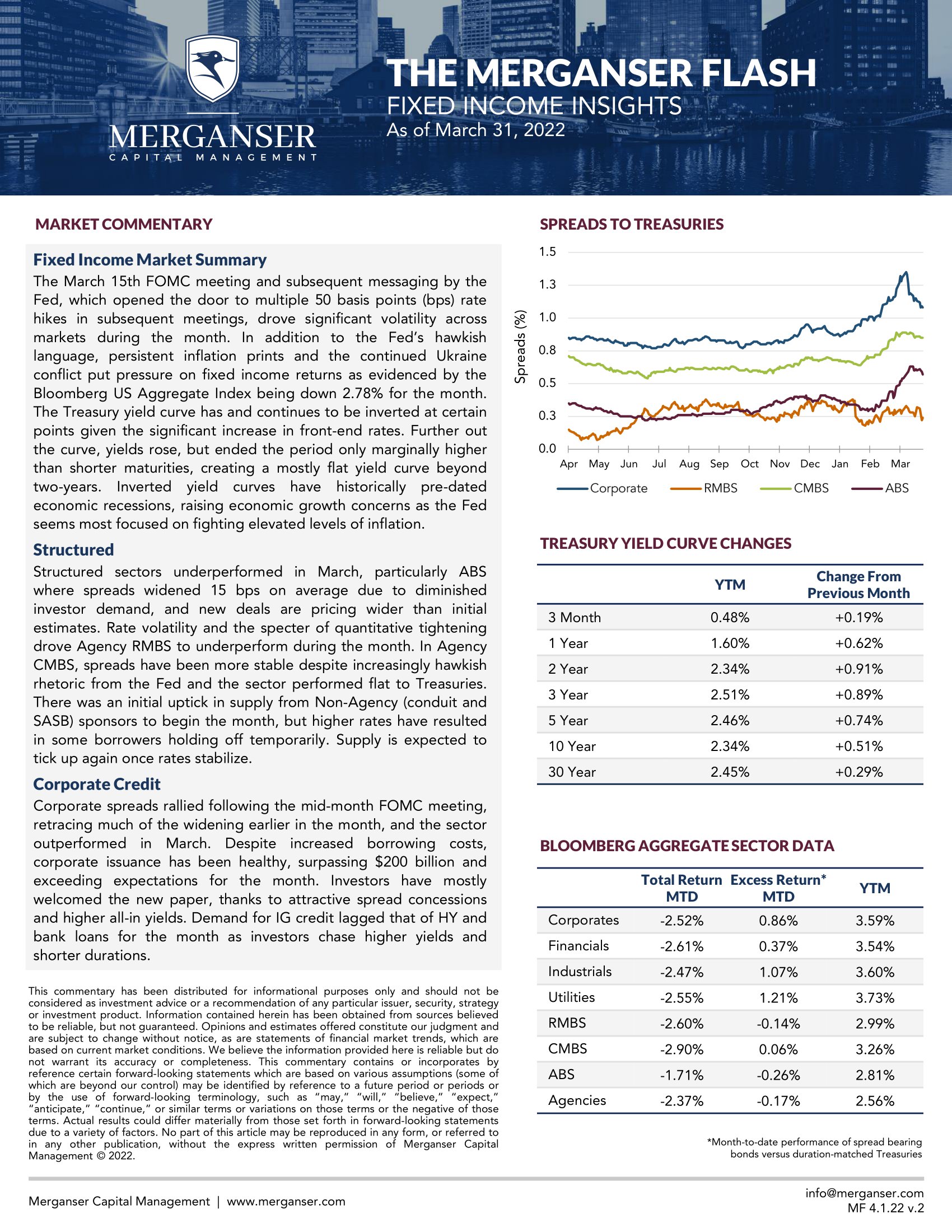

- In Investment Grade spread sectors, spreads widened across the board, led by financials. Following SVB’s collapse, market participants scoured the landscape of global financial institutions trying to discern which banks were most vulnerable. US regional banks continued to trade poorly while global giant Credit Suisse faced a crisis of confidence and was acquired by its competitor UBS in an emergency deal supported by the Swiss government.

- Agency RMBS was the best performing securitized subsector during March. Early in the month, spreads widened amid fears that like SVB, other banks would be forced to sell balance sheet RMBS holdings to fund withdrawal requests from depositors. The emergency implementation of the Bank Term Funding Program by the Fed helped quell these concerns and spreads largely recovered, ending the month modestly wider.

- ABS spreads also widened. Issuance was choppy and the deals that did come to market saw substantial new issue concessions due to lower demand. Collateral performance indicates that prime borrowers remain solid, while we continue to see deterioration in subprime auto and unsecured consumer loans.

- Non-Agency CMBS spreads widened as investors anticipated tighter lending conditions and pulled forward their expectations of a recession. The amount of primary market activity in Non-Agency CMBS remains well below historical averages, reflecting reduced investor appetite in the sector. Agency CMBS spreads widened less, supported by the sector’s government guarantee.