Fixed Income Market Summary

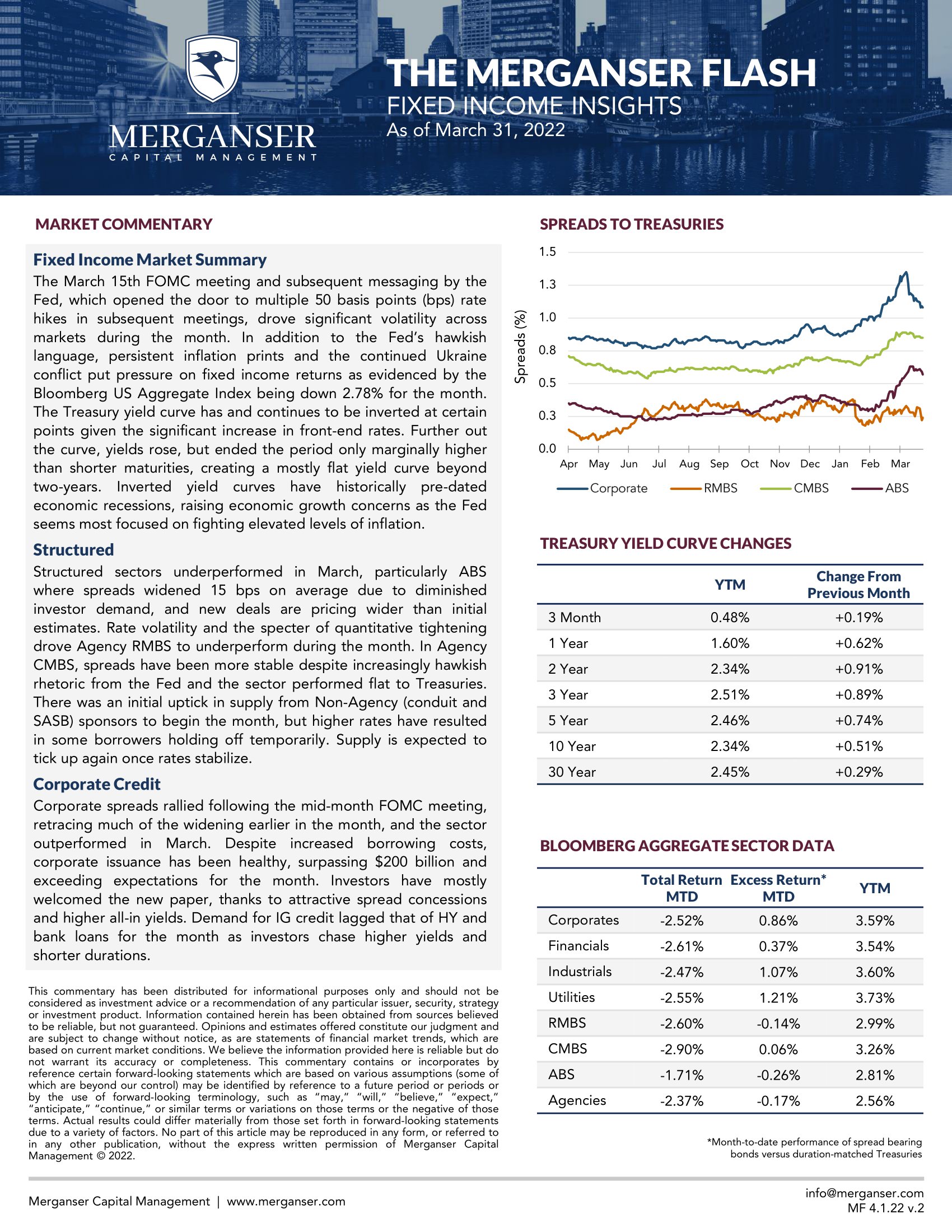

The March 15th FOMC meeting and subsequent messaging by the Fed, which opened the door to multiple 50 basis points (bps) rate hikes in subsequent meetings, drove significant volatility across markets during the month. In addition to the Fed’s hawkish language, persistent inflation prints and the continued Ukraine conflict put pressure on fixed income returns as evidenced by the Bloomberg US Aggregate Index being down 2.78% for the month. The Treasury yield curve has and continues to be inverted at certain points given the significant increase in front-end rates. Further out the curve, yields rose, but ended the period only marginally higher than shorter maturities, creating a mostly flat yield curve beyond two-years. Inverted yield curves have historically pre-dated economic recessions, raising economic growth concerns as the Fed seems most focused on fighting elevated levels of inflation.

Structured

Structured sectors underperformed in March, particularly ABS where spreads widened 15 bps on average due to diminished investor demand, and new deals are pricing wider than initial estimates. Rate volatility and the specter of quantitative tightening drove Agency RMBS to underperform during the month. In Agency CMBS, spreads have been more stable despite increasingly hawkish rhetoric from the Fed and the sector performed flat to Treasuries. There was an initial uptick in supply from Non-Agency (conduit and SASB) sponsors to begin the month, but higher rates have resulted in some borrowers holding off temporarily. Supply is expected to tick up again once rates stabilize.

Corporate Credit

Corporate spreads rallied following the mid-month FOMC meeting, retracing much of the widening earlier in the month, and the sector outperformed in March. Despite increased borrowing costs, corporate issuance has been healthy, surpassing $200 billion and exceeding expectations for the month. Investors have mostly welcomed the new paper, thanks to attractive spread concessions and higher all-in yields. Demand for IG credit lagged that of HY and bank loans for the month as investors chase higher yields and shorter durations.