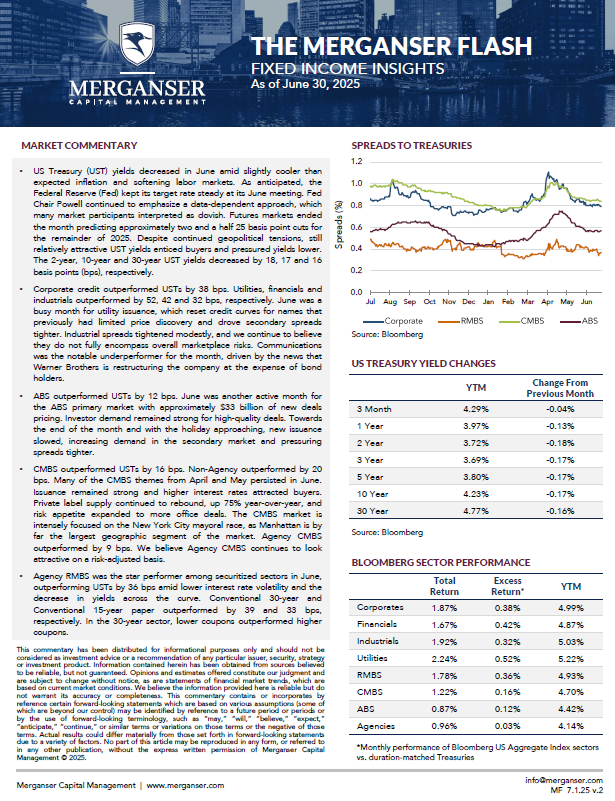

- US Treasury (UST) yields decreased in June amid slightly cooler than expected inflation and softening labor markets. As anticipated, the Federal Reserve (Fed) kept its target rate steady at its June meeting. Fed Chair Powell continued to emphasize a data-dependent approach, which many market participants interpreted as dovish. Futures markets ended the month predicting approximately two and a half 25 basis point cuts for the remainder of 2025. Despite continued geopolitical tensions, still relatively attractive UST yields enticed buyers and pressured yields lower. The 2-year, 10-year and 30-year UST yields decreased by 18, 17 and 16 basis points (bps), respectively.

- Corporate credit outperformed USTs by 38 bps. Utilities, financials and industrials outperformed by 52, 42 and 32 bps, respectively. June was a busy month for utility issuance, which reset credit curves for names that previously had limited price discovery and drove secondary spreads tighter. Industrial spreads tightened modestly, and we continue to believe they do not fully encompass overall marketplace risks. Communications was the notable underperformer for the month, driven by the news that Warner Brothers is restructuring the company at the expense of bond holders.

- ABS outperformed USTs by 12 bps. June was another active month for the ABS primary market with approximately $33 billion of new deals pricing. Investor demand remained strong for high-quality deals. Towards the end of the month and with the holiday approaching, new issuance slowed, increasing demand in the secondary market and pressuring spreads tighter.

- CMBS outperformed USTs by 16 bps. Non-Agency outperformed by 20 bps. Many of the CMBS themes from April and May persisted in June. Issuance remained strong and higher interest rates attracted buyers. Private label supply continued to rebound, up 75% year-over-year, and risk appetite expanded to more office deals. The CMBS market is intensely focused on the New York City mayoral race, as Manhattan is by far the largest geographic segment of the market. Agency CMBS outperformed by 9 bps. We believe Agency CMBS continues to look attractive on a risk-adjusted basis.

- Agency RMBS was the star performer among securitized sectors in June, outperforming USTs by 36 bps amid lower interest rate volatility and the decrease in yields across the curve. Conventional 30-year and Conventional 15-year paper outperformed by 39 and 33 bps, respectively. In the 30-year sector, lower coupons outperformed higher coupons.