- Early in the month, higher-than-expected inflation data for May sent US Treasury yields surging higher. Many market participants perceived the Fed as not eing aggressive enough in combating inflation. The following week, the Federal Open Market Committee responded by raising the Fed Funds rate by 75 basis points (bps), abandoning their prior guidance of 50 bps. Fed Chairman Jerome Powell indicated that another 75 bps increase could be warranted at the Fed’s July meeting.

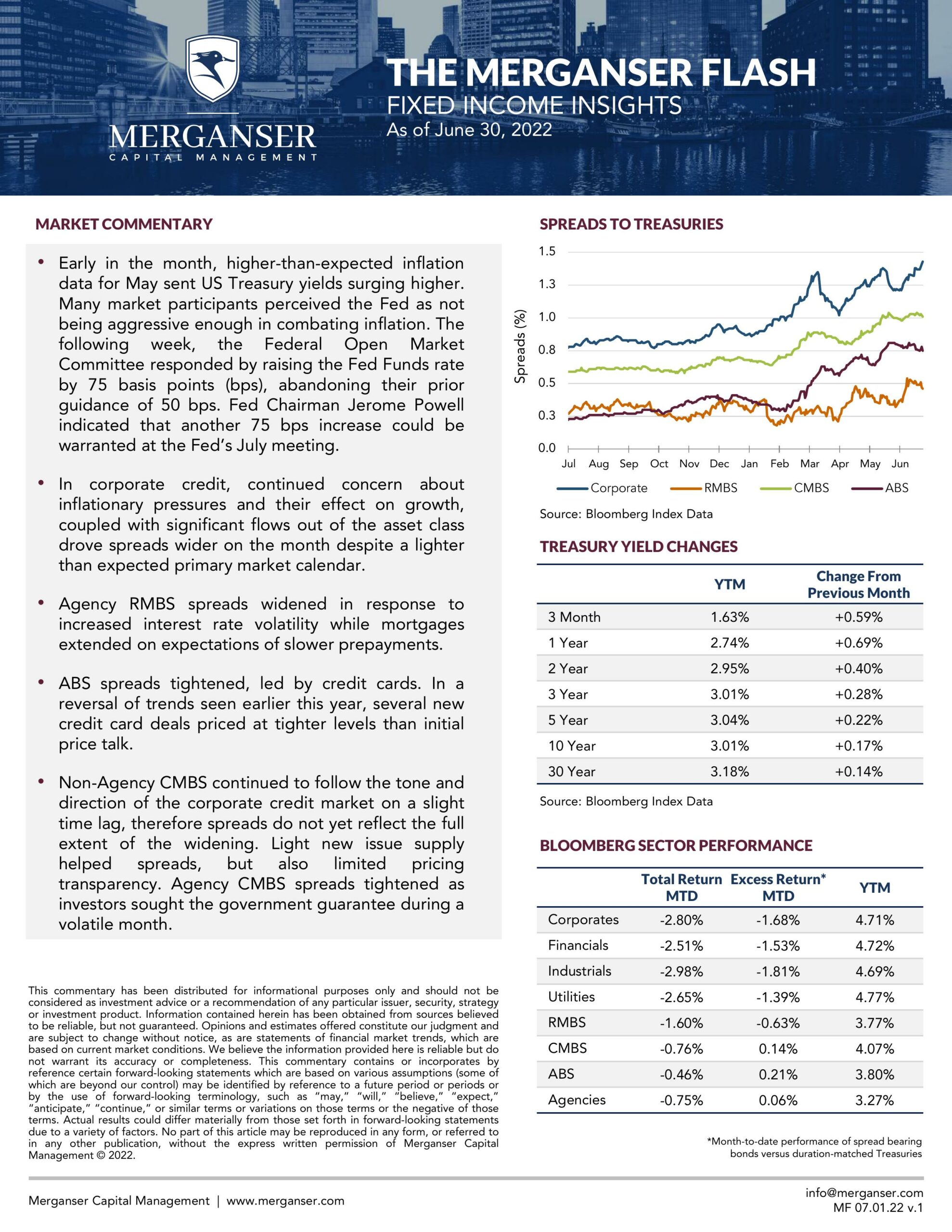

- In corporate credit, continued concern about inflationary pressures and their effect on growth, coupled with significant flows out of the asset class drove spreads wider on the month despite a lighter than expected primary market calendar.

- Agency RMBS spreads widened in response to increased interest rate volatility while mortgages extended on expectations of slower prepayments.

- ABS spreads tightened, led by credit cards. In a reversal of trends seen earlier this year, several new credit card deals priced at tighter levels than initial price talk.

- Non-Agency CMBS continued to follow the tone and direction of the corporate credit market on a slight time lag, therefore spreads do not yet reflect the full extent of the widening. Light new issue supply helped spreads, but also limited pricing transparency. Agency CMBS spreads tightened as investors sought the government guarantee during a volatile month.