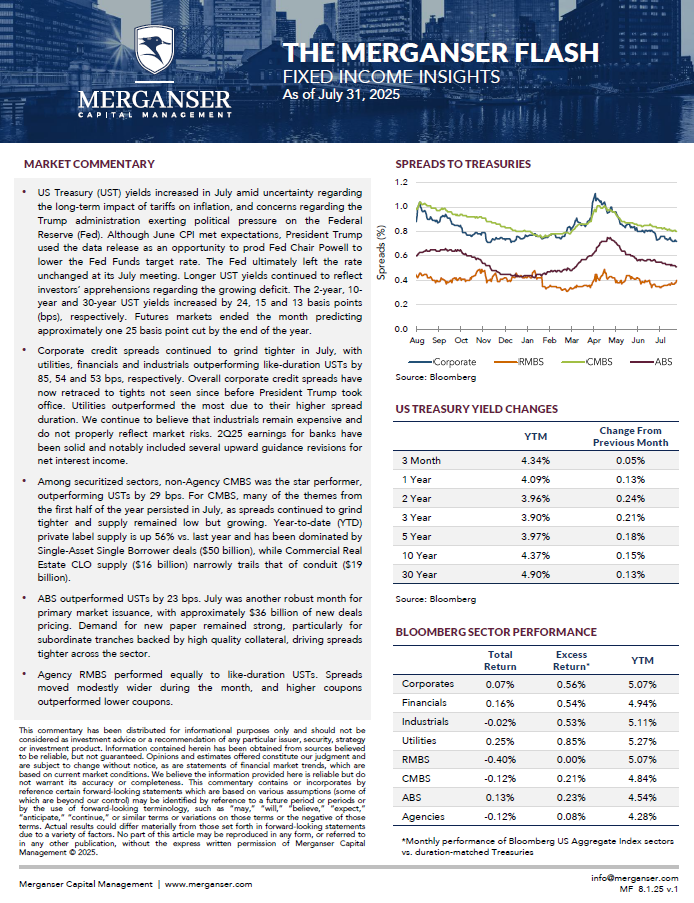

- US Treasury (UST) yields increased in July amid uncertainty regarding the long-term impact of tariffs on inflation, and concerns regarding the Trump administration exerting political pressure on the Federal Reserve (Fed). Although June CPI met expectations, President Trump used the data release as an opportunity to prod Fed Chair Powell to lower the Fed Funds target rate. The Fed ultimately left the rate unchanged at its July meeting. Longer UST yields continued to reflect investors’ apprehensions regarding the growing fiscal deficit. The 2-year, 10-year and 30-year UST yields increased by 24, 15 and 13 basis points (bps), respectively. Futures markets ended the month predicting approximately one 25 basis point cut by the end of the year.

- Corporate credit spreads continued to grind tighter in July, with utilities, financials and industrials outperforming like-duration USTs by 85, 54 and 53 bps, respectively. Overall corporate credit spreads have now retraced to tights not seen since before President Trump took office. Utilities outperformed the most due to their higher spread duration. We continue to believe that industrials remain expensive and do not properly reflect market risks. 2Q25 earnings for banks have been solid and notably included several upward guidance revisions for net interest income.

- Among securitized sectors, non-Agency CMBS was the star performer, outperforming USTs by 29 bps. For CMBS, many of the themes from the first half of the year persisted in July, as spreads continued to grind tighter and supply remained low but growing. Year-to-date (YTD) private label supply is up 56% vs. last year and has been dominated by Single-Asset Single Borrower deals ($50 billion), while Commercial Real Estate CLO supply ($16 billion) narrowly trails that of conduit ($19 billion).

- ABS outperformed USTs by 23 bps. July was another robust month for primary market issuance, with approximately $36 billion of new deals pricing. Demand for new paper remained strong, particularly for subordinate tranches backed by high quality collateral, driving spreads tighter across the sector.

- Agency RMBS performed equally to like-duration USTs. Spreads moved modestly wider during the month, and higher coupons outperformed lower coupons.