- Heightened geopolitical tensions, expectations of slower policy easing, and rising sovereign yields generally pushed US Treasury (UST) yields higher during January. Sharp increases in Japanese government bond yields spilled over to US markets amid a further unwind of the Yen carry trade. The 2-year, 10-year and 30-year UST yields increased by 5, 7 and 3 basis points (bps), respectively. Futures markets ended the month predicting approximately two 25 basis point rate cuts in 2026.

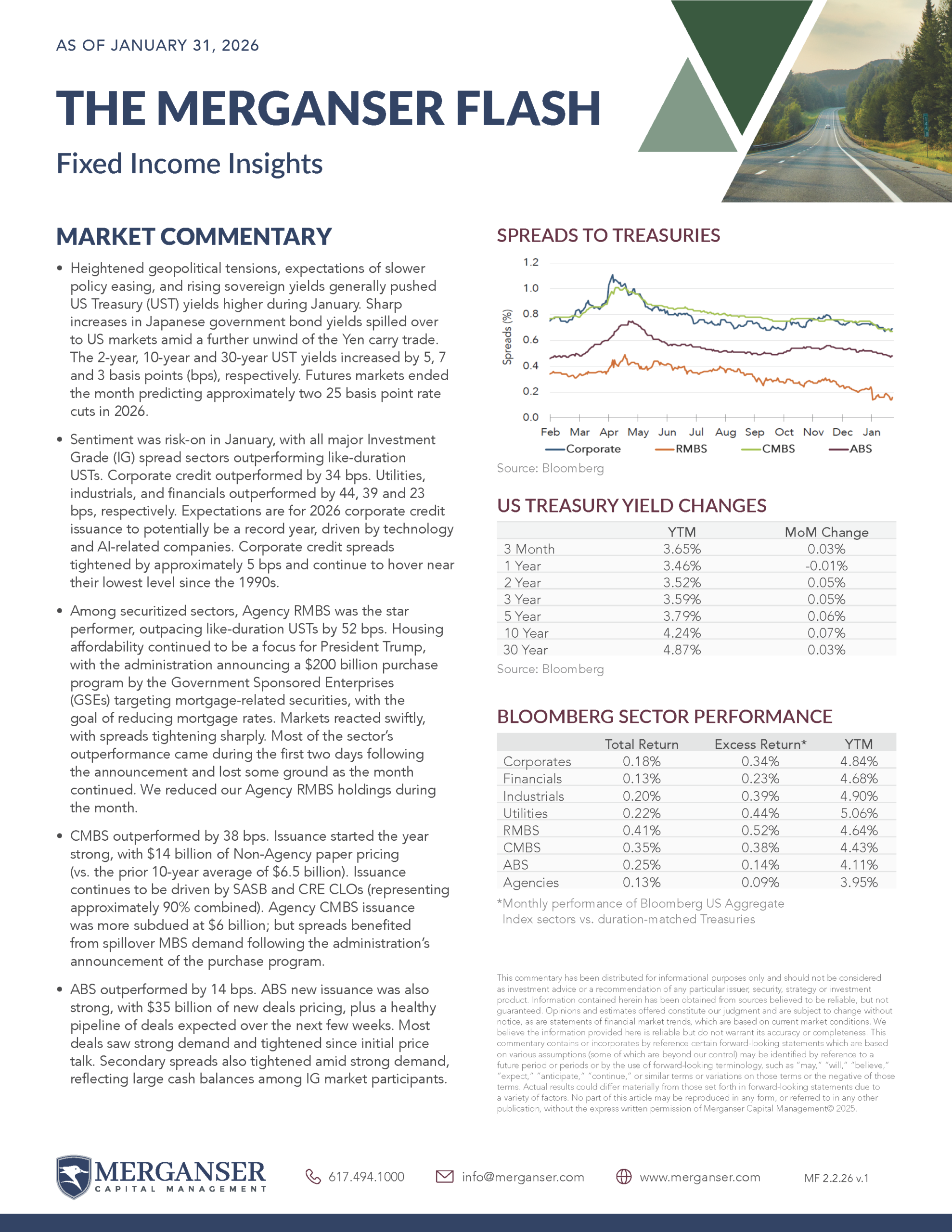

- Sentiment was risk-on in January, with all major Investment Grade (IG) spread sectors outperforming like-duration USTs. Corporate credit outperformed by 34 bps. Utilities, industrials, and financials outperformed by 44, 39 and 23 bps, respectively. Expectations are for 2026 corporate credit issuance to potentially be a record year, driven by technology and AI-related companies. Corporate credit spreads tightened by approximately 5 bps and continue to hover near their lowest level since the 1990s.

- Among securitized sectors, Agency RMBS was the star performer, outpacing like-duration USTs by 52 bps. Housing affordability continued to be a focus for President Trump, with the administration announcing a $200 billion purchase program by the Government Sponsored Enterprises (GSEs) targeting mortgage‑related securities, with the goal of reducing mortgage rates. Markets reacted swiftly, with spreads tightening sharply.

- CMBS outperformed by 38 bps. Issuance started the year strong, with $14 billion of Non-Agency paper pricing (vs. the prior 10-year average of $6.5 billion). Issuance continues to be driven by SASB and CRE CLOs (representing approximately 90% combined). Agency CMBS issuance was more subdued at $6 billion; but spreads benefited from spillover MBS demand following the administration’s announcement of the purchase program.

- ABS outperformed by 14 bps. ABS new issuance was also strong, with $35 billion of new deals pricing, plus a healthy pipeline of deals expected over the next few weeks. Most deals saw strong demand and tightened since initial price talk. Secondary spreads also tightened amid strong demand, reflecting large cash balances among IG market participants.