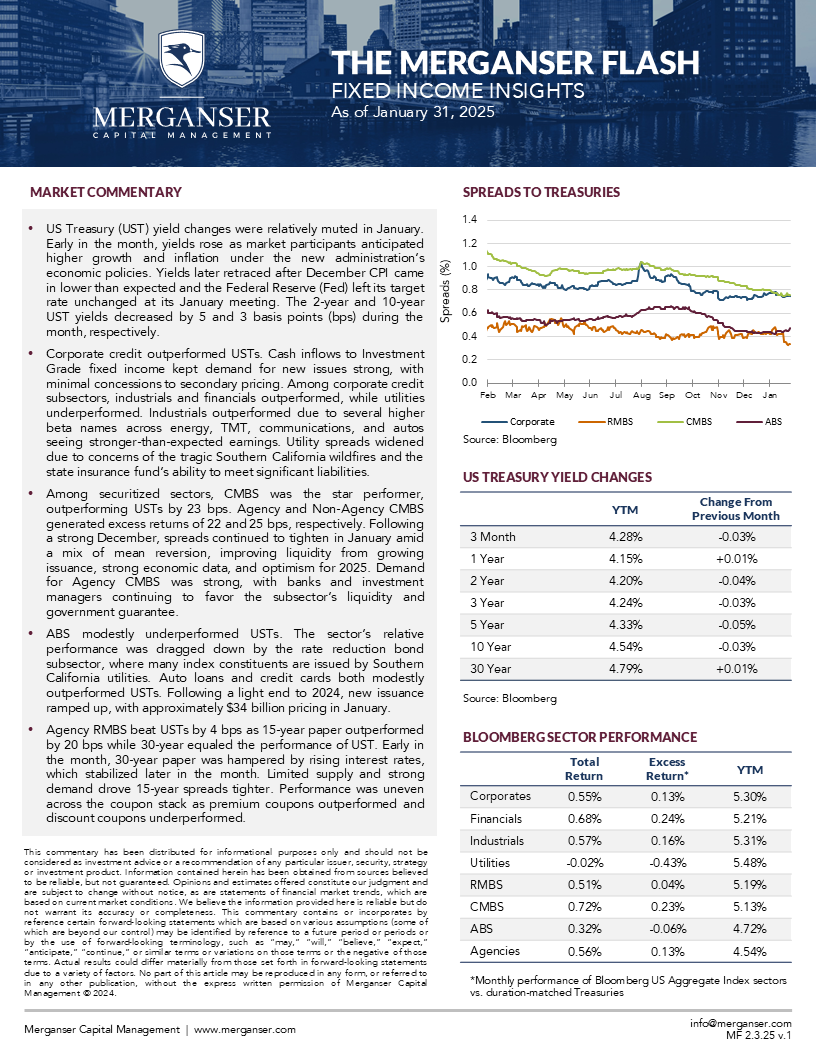

- US Treasury (UST) yield changes were relatively muted in January. Early in the month, yields rose as market participants anticipated higher growth and inflation under the new administration’s economic policies. Yields later retraced after December CPI came in lower than expected and the Federal Reserve (Fed) left its target rate unchanged at its January meeting. The 2-year and 10-year UST yields decreased by 5 and 3 basis points (bps) during the month, respectively.

- Corporate credit outperformed USTs. Cash inflows to Investment Grade fixed income kept demand for new issues strong, with minimal concessions to secondary pricing. Among corporate credit subsectors, industrials and financials outperformed, while utilities underperformed. Industrials outperformed due to several higher beta names across energy, TMT, communications, and autos seeing stronger-than-expected earnings. Utility spreads widened due to concerns about the tragic Southern California wildfires and the state insurance fund’s ability to meet significant liabilities.

- Among securitized sectors, CMBS was the star performer, outperforming USTs by 23 bps. Agency and Non-Agency CMBS generated excess returns of 22 and 25 bps, respectively. Following a strong December, spreads continued to tighten in January amid a mix of mean reversion, improving liquidity from growing issuance, strong economic data, and optimism for 2025. Demand for Agency CMBS was strong, with banks and investment managers continuing to favor the subsector’s liquidity and government guarantee.

- ABS modestly underperformed USTs. The sector’s relative performance was dragged down by the rate reduction bond subsector, where many index constituents are issued by Southern California utilities. Auto loans and credit cards both modestly outperformed USTs. Following a light end to 2024, new issuance ramped up, with approximately $34 billion pricing in January.

- Agency RMBS beat USTs by 4 bps as 15-year paper outperformed by 20 bps while 30-year equaled the performance of UST. Early in the month, 30-year paper was hampered by rising interest rates, which stabilized later in the month. Limited supply and strong demand drove 15-year spreads tighter. Performance was uneven across the coupon stack as premium coupons outperformed and discount coupons underperformed.