Fixed Income Market Summary

The Russian invasion of Ukraine dominated headlines toward the end of the month, sparking a wave of volatility across markets globally. Within domestic fixed income, we saw a flight to quality as geopolitical tensions rose despite strong mid-month economic data domestically. The war on Ukraine is only increasing inflationary pressures as seen by the Fed Funds futures which have dramatically reversed in recent days. The market is now pricing in a 50 basis points (bps) rate hike with single digit percentage odds, down from 80% earlier in the month. Given these headwinds, issuance was less robust than expected for the month. There remains pent up demand to issue, but new issue concessions are deterring opportunistic issuance until volatility subsides.

Structured

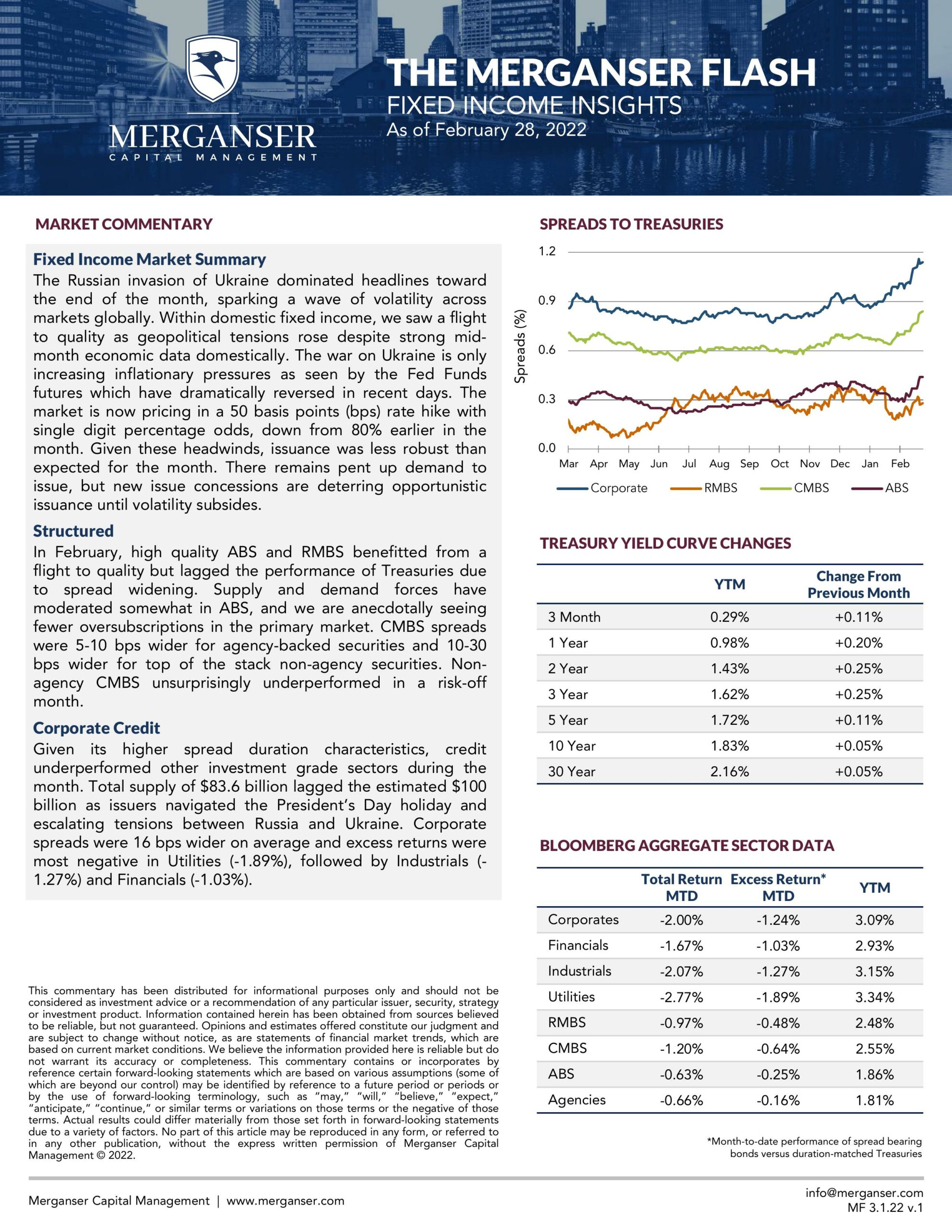

In February, high quality ABS and RMBS benefitted from a flight to quality but lagged the performance of Treasuries due to spread widening. Supply and demand forces have moderated somewhat in ABS, and we are anecdotally seeing fewer oversubscriptions in the primary market. CMBS spreads were 5-10 bps wider for agency-backed securities and 10-30 bps wider for top of the stack non-agency securities. Non-agency CMBS unsurprisingly underperformed in a risk-off month.

Corporate Credit

Given its higher spread duration characteristics, credit underperformed other investment grade sectors during the month. Total supply of $83.6 billion lagged the estimated $100 billion as issuers navigated the President’s Day holiday and escalating tensions between Russia and Ukraine. Corporate spreads were 16 bps wider on average and excess returns were most negative in Utilities (-1.89%), followed by Industrials (-1.27%) and Financials (-1.03%).