- As anticipated, the Federal Reserve (Fed) cut interest rates by 25 basis points (bps) at its December meeting, marking the third consecutive meeting of policy easing. However, the accompanying Summary of Economic Projections revealed increasing dissent among Fed officials regarding the appropriate path forward. Later in the month, the Bureau of Labor Statistics released employment data for November. Nonfarm payrolls increased by approximately 64,000 and the unemployment rate increased to 4.6%. The US Treasury (UST) yield curve steepened during December. The 2-year yield decreased by 2 bps while the 10-year and 30-year yields increased by 15 and 18 bps, respectively. Futures markets ended the month predicting approximately two 25 basis point rate cuts in 2026.

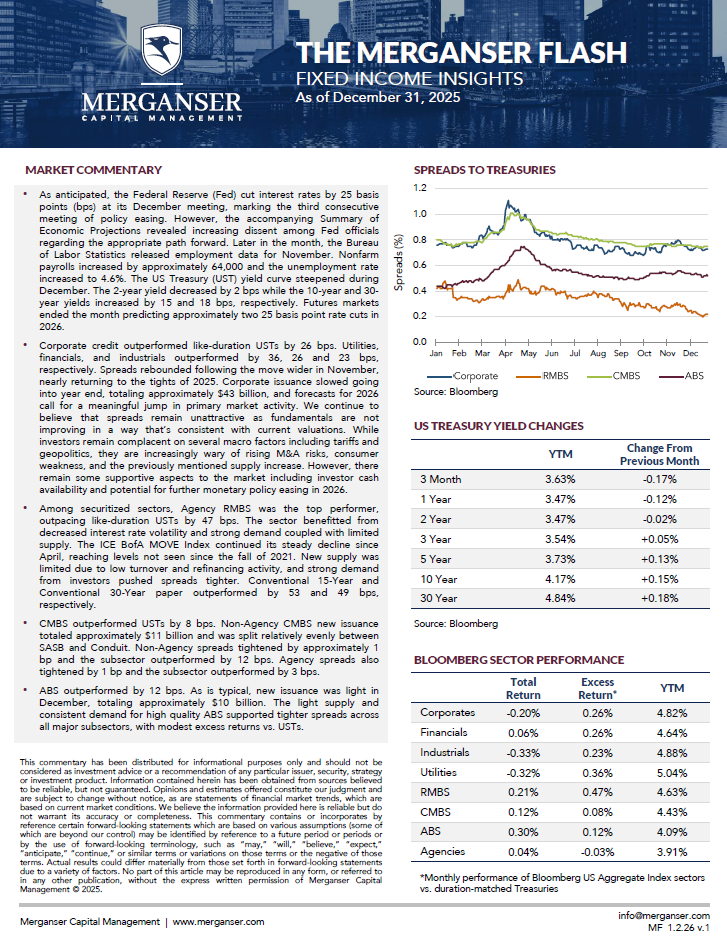

- Corporate credit outperformed like-duration USTs by 26 bps. Utilities, financials, and industrials outperformed by 36, 26 and 23 bps, respectively. Spreads rebounded following the move wider in November, nearly returning to the tights of 2025. Corporate issuance slowed going into year end, totaling approximately $43 billion, and forecasts for 2026 call for a meaningful jump in primary market activity. We continue to believe that spreads remain unattractive as fundamentals are not improving in a way that’s consistent with current valuations. While investors remain complacent on several macro factors including tariffs and geopolitics, they are increasingly wary of rising M&A risks, consumer weakness, and the previously mentioned supply increase. However, there remain some supportive aspects to the market including investor cash availability and potential for further monetary policy easing in 2026.

- Among securitized sectors, Agency RMBS was the top performer, outpacing like-duration USTs by 47 bps. The sector benefitted from decreased interest rate volatility and strong demand coupled with limited supply. The ICE BofA MOVE Index continued its steady decline since April, reaching levels not seen since the fall of 2021. New supply was limited due to low turnover and refinancing activity, and strong demand from investors pushed spreads tighter. Conventional 15-Year and Conventional 30-Year paper outperformed by 53 and 49 bps, respectively.

- CMBS outperformed USTs by 8 bps. Non-Agency CMBS new issuance totaled approximately $11 billion and was split relatively evenly between SASB and Conduit. Non-Agency spreads tightened by approximately 1 bp and the subsector outperformed by 12 bps. Agency spreads also tightened by 1 bp and the subsector outperformed by 3 bps.

- ABS outperformed by 12 bps. As is typical, new issuance was light in December, totaling approximately $10 billion. The light supply and consistent demand for high quality ABS supported tighter spreads across all major subsectors, with modest excess returns vs. USTs.