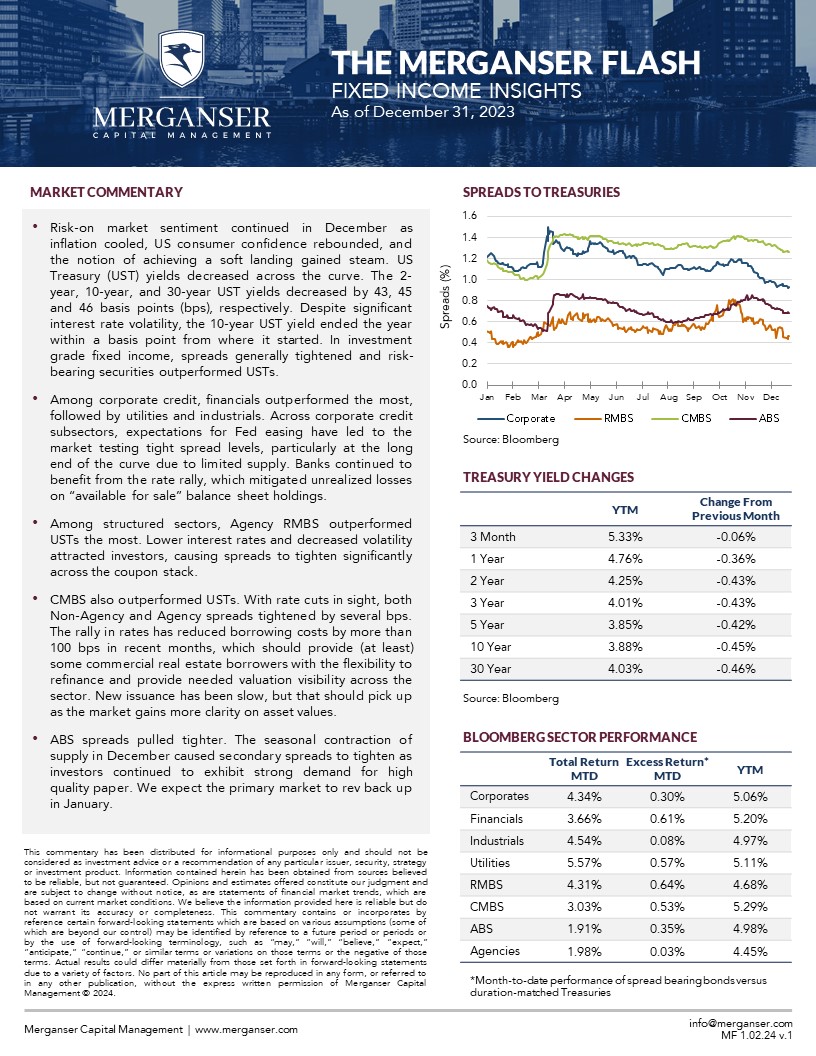

- Risk-on market sentiment continued in December as inflation cooled, US consumer confidence rebounded, and the notion of achieving a soft landing gained steam. US Treasury (UST) yields decreased across the curve. The 2-year, 10-year, and 30-year UST yields decreased by 43, 45 and 46 basis points (bps), respectively. Despite significant interest rate volatility, the 10-year UST yield ended the year within a basis point from where it started. In investment grade fixed income, spreads generally tightened and risk-bearing securities outperformed USTs.

- Among corporate credit, financials outperformed the most, followed by utilities and industrials. Across corporate credit subsectors, expectations for Fed easing have led to the market testing tight spread levels, particularly at the long end of the curve due to limited supply. Banks continued to benefit from the rate rally, which mitigated unrealized losses on “available for sale” balance sheet holdings.

- Among structured sectors, Agency RMBS outperformed USTs the most. Lower interest rates and decreased volatility attracted investors, causing spreads to tighten significantly across the coupon stack.

- CMBS also outperformed USTs. With rate cuts in sight, both Non-Agency and Agency spreads tightened by several bps. The rally in rates has reduced borrowing costs by more than 100 bps in recent months, which should provide (at least) some commercial real estate borrowers with the flexibility to refinance and provide needed valuation visibility across the sector. New issuance has been slow, but that should pick up as the market gains more clarity on asset values.

- ABS spreads pulled tighter. The seasonal contraction of supply in December caused secondary spreads to tighten as investors continued to exhibit strong demand for high quality paper. We expect the primary market to rev back up in January.