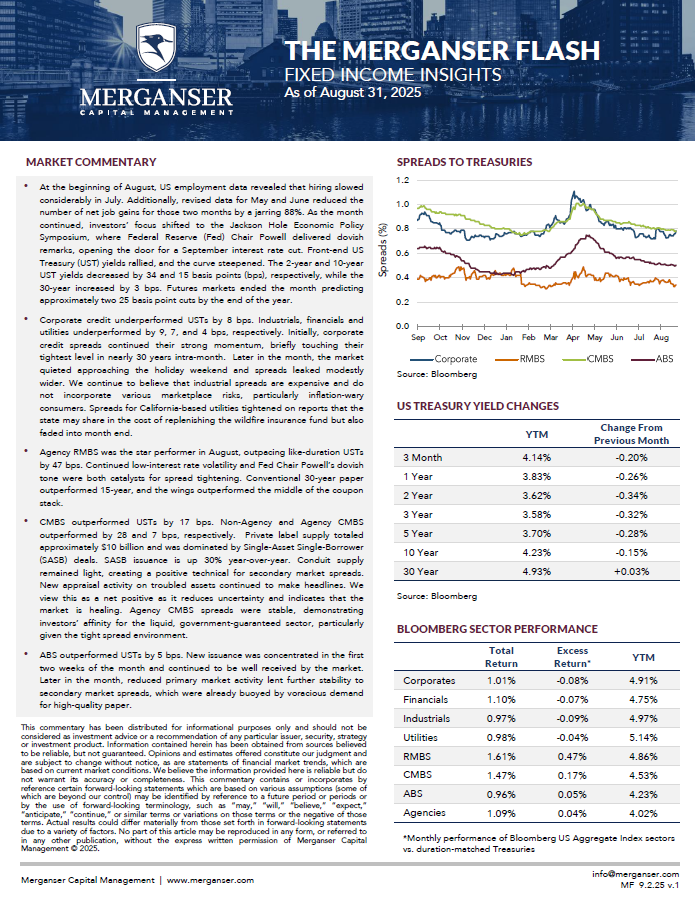

- At the beginning of August, US employment data revealed that hiring slowed considerably in July. Additionally, revised data for May and June reduced the number of net job gains for those two months by a jarring 88%. As the month continued, investors’ focus shifted to the Jackson Hole Economic Policy Symposium, where Federal Reserve (Fed) Chair Powell delivered dovish remarks, opening the door for a September interest rate cut. Front-end US Treasury (UST) yields rallied, and the curve steepened. The 2-year and 10-year UST yields decreased by 34 and 15 basis points (bps), respectively, while the 30-year increased by 3 bps. Futures markets ended the month predicting approximately two 25 basis point cuts by the end of the year.

- Corporate credit underperformed USTs by 8 bps. Industrials, financials, and utilities underperformed by 9, 7, and 4 bps, respectively. Initially, corporate credit spreads continued their strong momentum, briefly touching their tightest level in nearly 30 years intra-month. Later in the month, the market quieted approaching the holiday weekend and spreads leaked modestly wider. We continue to believe that industrial spreads are expensive and do not incorporate various marketplace risks, particularly inflation-wary consumers. Spreads for California-based utilities tightened on reports that the state may share in the cost of replenishing the wildfire insurance fund but also faded into month end.

- Agency RMBS was the star performer in August, outpacing like-duration USTs by 47 bps. Continued low-interest rate volatility and Fed Chair Powell’s dovish tone were both catalysts for spread tightening. Conventional 30-year paper outperformed 15-year, and the wings outperformed the middle of the coupon stack.

- CMBS outperformed USTs by 17 bps. Non-Agency and Agency CMBS outperformed by 28 and 7 bps, respectively. Private label supply totaled approximately $10 billion and was dominated by Single-Asset Single-Borrower (SASB) deals. SASB issuance is up 30% year-over-year. Conduit supply remained light, creating a positive technical for secondary market spreads. New appraisal activity on troubled assets continued to make headlines. We view this as a net positive as it reduces uncertainty and indicates that the market is healing. Agency CMBS spreads were stable, demonstrating investors’ affinity for the liquid, government-guaranteed sector, particularly given the tight spread environment.

- ABS outperformed USTs by 5 bps. New issuance was concentrated in the first two weeks of the month and continued to be well received by the market. Later in the month, reduced primary market activity lent further stability to secondary market spreads, which were already buoyed by voracious demand for high-quality paper.