- On August 2nd, US labor market data revealed that hiring slowed substantially in July and the unemployment rate increased to 4.3%, elevating recession concerns. Stocks sold off and US Treasury (UST) yields declined.

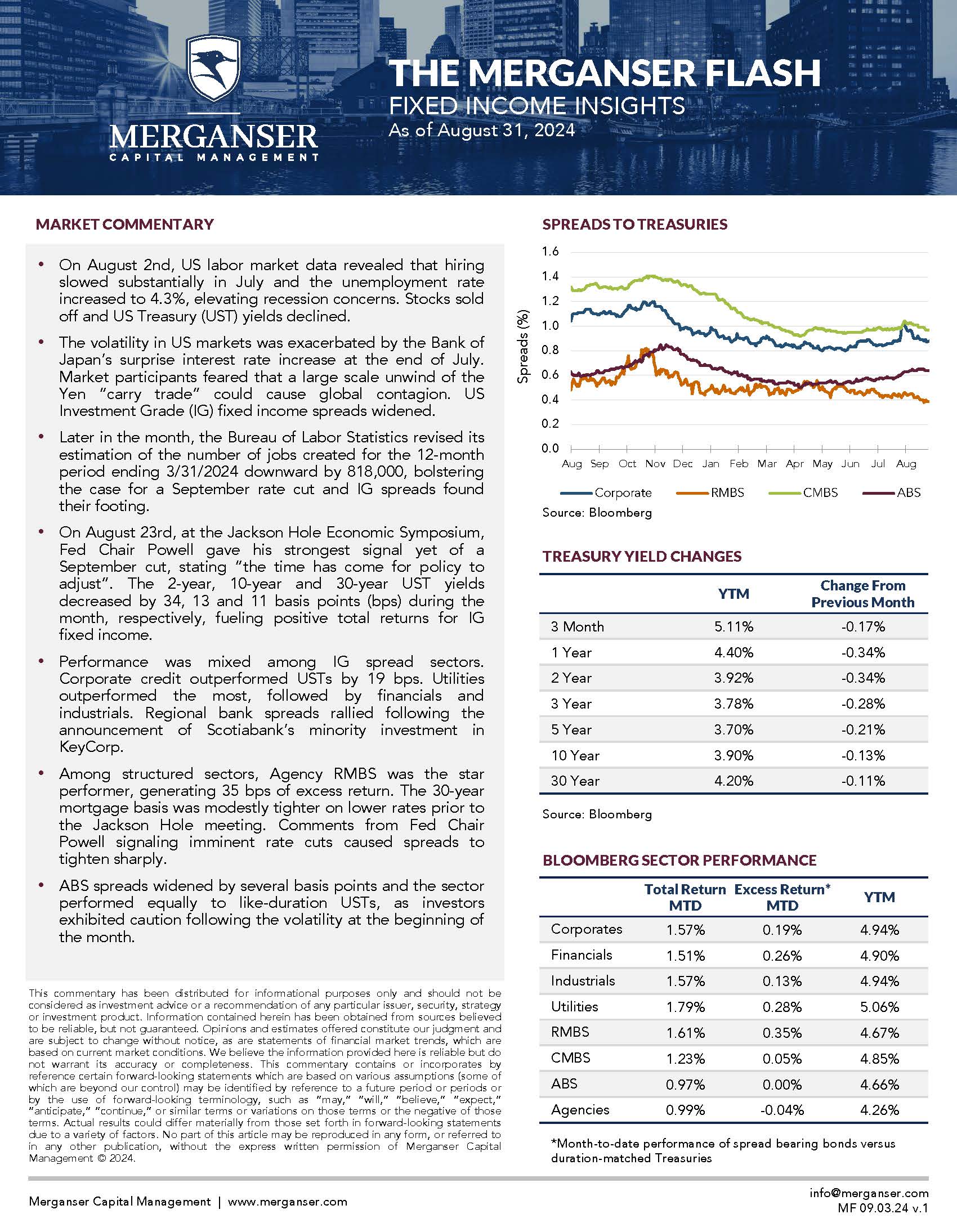

- The volatility in US markets was exacerbated by the Bank of Japan’s surprise interest rate increase at the end of July. Market participants feared that a large scale unwind of the Yen “carry trade” could cause global contagion. US Investment Grade (IG) fixed income spreads widened.

- Later in the month, the Bureau of Labor Statistics revised its estimation of the number of jobs created for the 12-month period ending 3/31/2024 downward by 818,000, bolstering the case for a September rate cut and IG spreads found their footing.

- On August 23rd, at the Jackson Hole Economic Symposium, Fed Chair Powell gave his strongest signal yet of a September cut, stating “the time has come for policy to adjust”. The 2-year, 10-year and 30-year UST yields decreased by 34, 13 and 11 basis points (bps) during the month, respectively, fueling positive total returns for IG fixed income.

- Performance was mixed among IG spread sectors. Corporate credit outperformed USTs by 19 bps. Utilities outperformed the most, followed by financials and industrials. Regional bank spreads rallied following the announcement of Scotiabank’s minority investment in KeyCorp.

- Among structured sectors, Agency RMBS was the star performer, generating 35 bps of excess return. The 30-year mortgage basis was modestly tighter on lower rates prior to the Jackson Hole meeting. Comments from Fed Chair Powell signaling imminent rate cuts caused spreads to tighten sharply.

- ABS spreads widened by several basis points and the sector performed equally to like-duration USTs, as investors exhibited caution following the volatility at the beginning of the month.