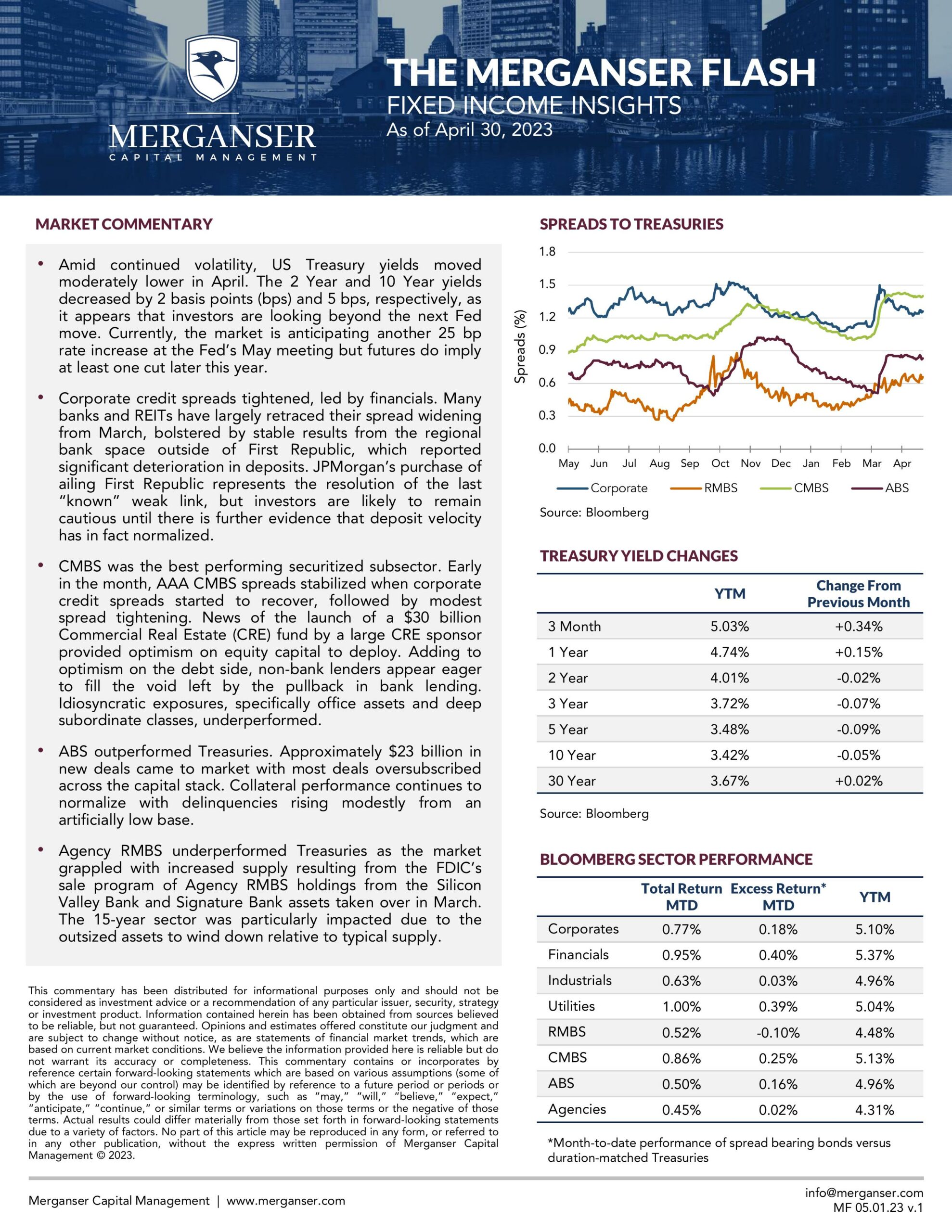

- Amid continued volatility, US Treasury yields moved moderately lower in April. The 2 Year and 10 Year yields decreased by 2 basis points (bps) and 5 bps, respectively, as it appears that investors are looking beyond the next Fed move. Currently, the market is anticipating another 25 bp rate increase at the Fed’s May meeting but futures do imply at least one cut later this year.

- Corporate credit spreads tightened, led by financials. Many banks and REITs have largely retraced their spread widening from March, bolstered by stable results from the regional bank space outside of First Republic, which reported significant deterioration in deposits. JPMorgan’s purchase of ailing First Republic represents the resolution of the last “known” weak link, but investors are likely to remain cautious until there is further evidence that deposit velocity has in fact normalized.

- CMBS was the best performing securitized subsector. Early in the month, AAA CMBS spreads stabilized when corporate credit spreads started to recover, followed by modest spread tightening. News of the launch of a $30 billion Commercial Real Estate (CRE) fund by a large CRE sponsor provided optimism on equity capital to deploy. Adding to optimism on the debt side, non-bank lenders appear eager to fill the void left by the pullback in bank lending. Idiosyncratic exposures, specifically office assets and deep subordinate classes, underperformed.

- ABS outperformed Treasuries. Approximately $23 billion in new deals came to market with most deals oversubscribed across the capital stack. Collateral performance continues to normalize with delinquencies rising modestly from an artificially low base.

- Agency RMBS underperformed Treasuries as the market grappled with increased supply resulting from the FDIC’s sale program of Agency RMBS holdings from the Silicon Valley Bank and Signature Bank assets taken over in March. The 15-year sector was particularly impacted due to the outsized assets to wind down relative to typical supply.